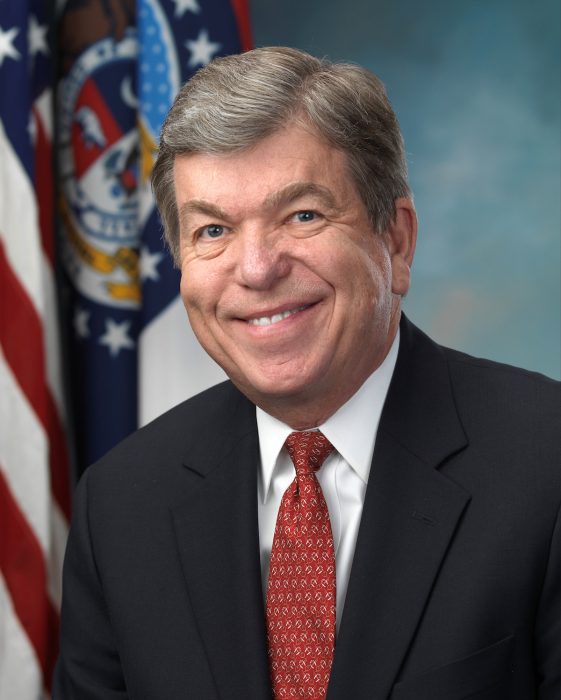

Three United States senators have introduced a bipartisan bill to help make adopting affordable for families nationwide. U.S. Senators Roy Blunt (R-MO), Bob Casey (D-PA), and James Inhofe (R-OK) announced the Adoption Tax Credit Refundability Act, which will make the adoption tax credit fully refundable. In a news release, Sen. Blunt said, “Over 100,000 children are waiting for adoption into a family who can give them the loving home they deserve. This bipartisan bill will restore the refundability portion of the tax credit to make adoption more affordable for hardworking families….”

Sen. Roy Blunt

The news release notes the necessity of the bill:

The adoption tax credit was made permanent in the American Taxpayer Relief Act in January 2013. However, that law did not extend the refundability provisions that applied to the adoption tax credit in 2010 and 2011. The Adoption Tax Credit Refundability Act would restore the refundable portion of this critical support for families wishing to adopt.

According to the Department of Health and Human Services, about one-third of all adopted children live in families with annual household incomes at or below 200 percent of the poverty level. Despite the common misperception that only wealthy families adopt, nearly 46 percent of children adopted from foster care live in families with incomes at or below 200 percent of the federal poverty level. Many of these families’ income taxes are so low that they cannot benefit from the adoption tax credit at all unless it is refundable.

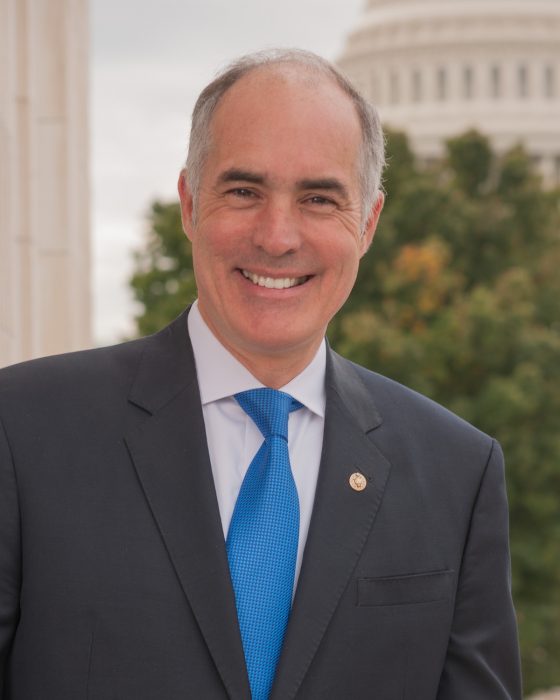

Sen. Casey added, “It is a common misconception that only wealthy families adopt…. This legislation is a commonsense approach to improve lower-income families’ ability to adopt and support children from foster care.”

Sen. Bob Casey

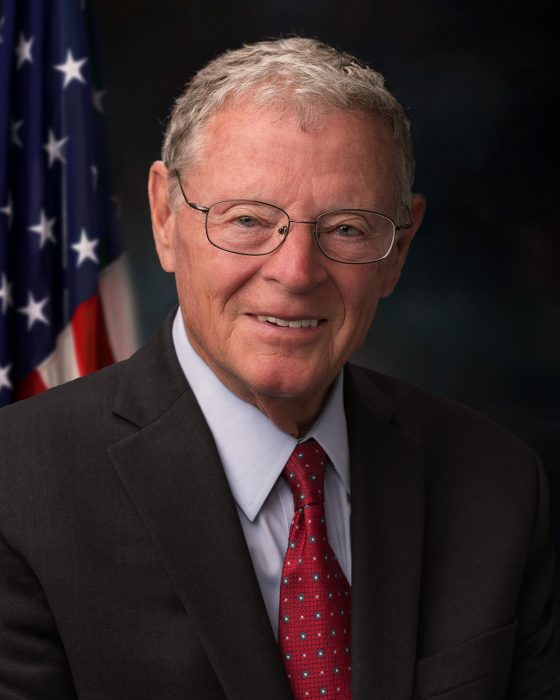

For Oklahoma Sen. Inhofe, adoption hits close to home. He says, “My family knows firsthand the joys and blessings adoption brings. But adoption is not without its difficulties and, too often, can be a costly process. Making the adoption tax credit fully refundable will ease that financial burden so more families can choose to adopt and welcome children into their homes.”

Sen. Jim Inhofe

Indeed, Inhofe’s Senator page includes a special link to adoption resources. On that page, he says:

The story of my involvement with intercountry adoption is a very personal one. My granddaughter, Zegita Marie, or “Z-girl” as I call her, was adopted by my daughter Molly from an orphanage in Ethiopia as a baby. Because of my personal involvement and my extensive travels throughout Africa, I know firsthand the difficulties and sensitivities surrounding intercountry adoption, and I know of the challenges that families face. But I also know of the many blessings that come from giving a child a family. I hope that you will join with me in recognizing the great need that exists for families who are willing to open their arms to children, both here in the United States and abroad, and take the leap of faith that will change a child’s life.” – U.S. Sen. Jim Inhofe

A large number of the 62 percent of families who filed for the adoption tax credit benefited from refundability, the news release states, and 41 percent of those had annual gross incomes of under $50,000, further showing the need for this bill.

“Like” Live Action News on Facebook for more pro-life news and commentary!